-

It's kind of crazy that it's been nearly a year since last doing a batch of work on this - not sure where the time has gone. My learnings in the past year:

-

On Behaviours

-

Opening up Clerk on a regular basis just never became a habit that stuck. I would leave it unopened for months and then open it when I was having anxiety around money or wondering where my spending was going. I definitely personally have avoidance issues around money, but I'm guessing this is also true for most people.

-

At some point I wanted to do some research for business expenses and I threw my raw revolut export into a google sheet. This behaviour persisted much more than opening up Clerk - I think the combination of G sheets being familiar, and the amount of control that comes from a spreadsheet, had more of a draw.

-

Over time I got really sophisticated with the spreadsheet, eventually landing on a formula based approach that almost mimicked the Clerk UI. I had all of my categories listed in the first sheet and then a category column in the transactions spreadsheet that pulled them in dynamically, and a table that shows category breakdowns over time.

-

-

On Features

-

Despite doing reasonably well this year, there were still multiple months where I dipped into my savings before the month is out. I really regret this and wish I'd have been more controlled/intentional around that. My problem really stemmed from making poor decisions at the beginning of the month and accumulating more spend that I should have.

-

That said, I still haven't found a system simple enough to give me a no brainer answer to "Should I make this purchase". The ideal would be some set of the following:

-

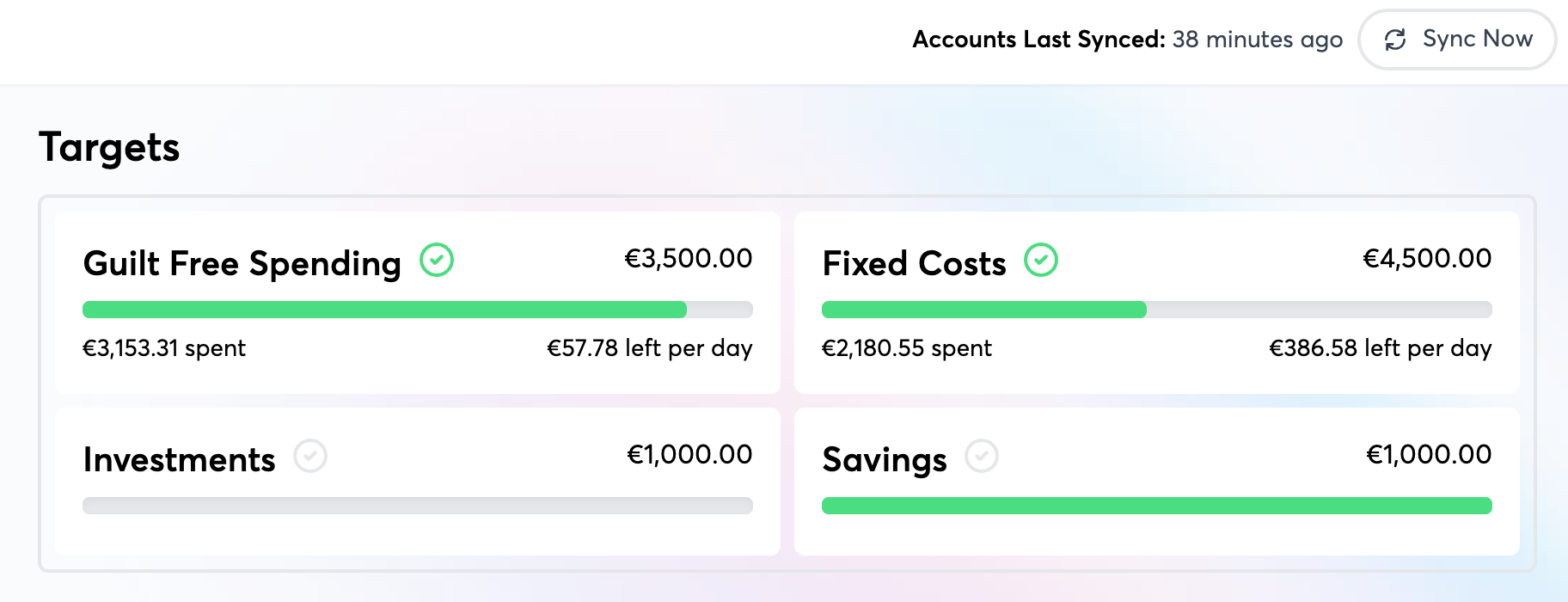

When salary gets paid, subtract fixed and recurring costs to get the total amount of discretionary spend available for the month. Then divide this by the amount of days in the month and show a "You have $X per day". Then as the month progresses show some indicator as to whether you're adhering to that or going over. Then you can make decisions about purchases based on how much you've gone over or under your baseline per day.

-

-

Tying this Together

-

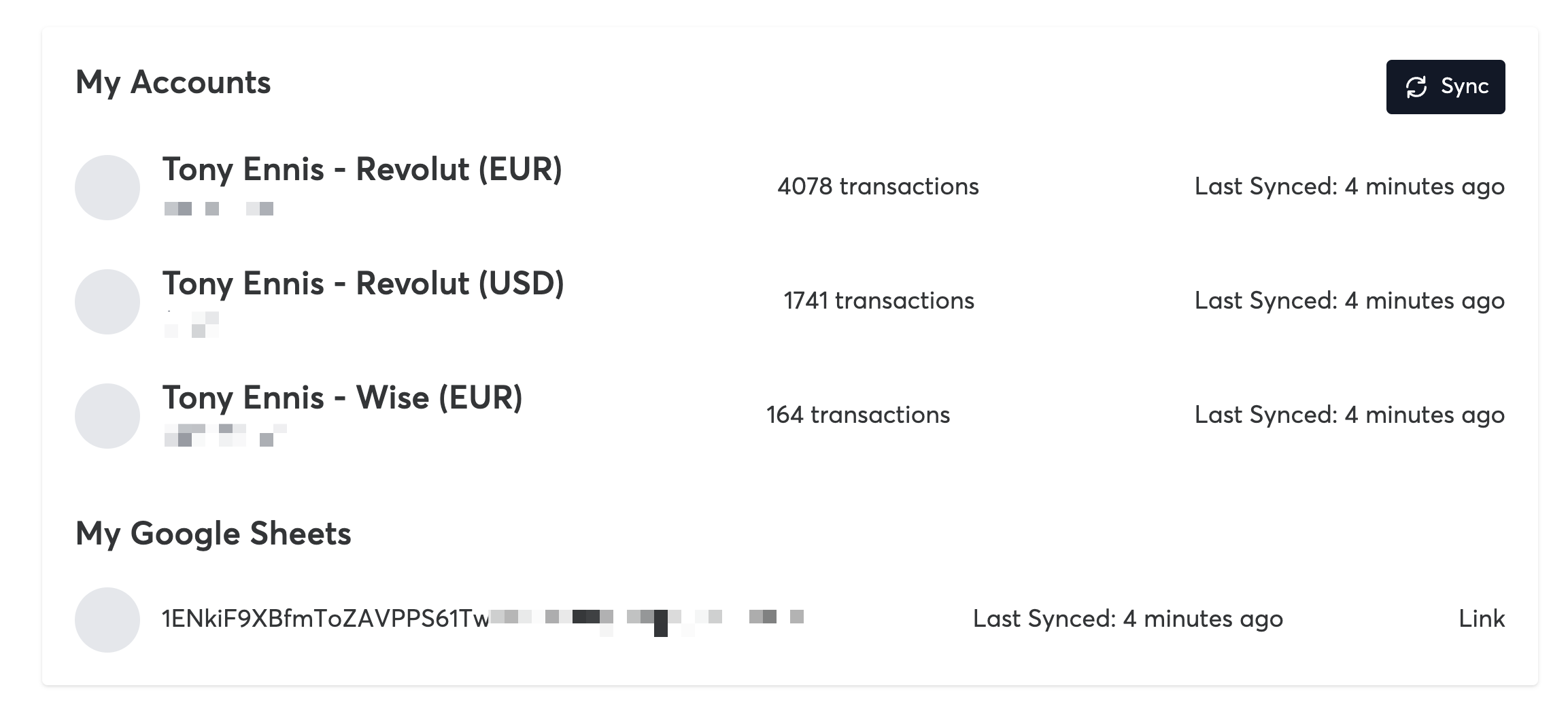

What I'm now thinking about is Clerk the app being a companion to a Google Sheet.

-

The sheet could either be given away for free or sold as a one time payment. There's enough value in the sheet itself to exist separately to the app. And we could do up a little help center and set of videos on how to use it.

-

Continuous Sync: No need to export as csv and import into G sheets which is a pain

-

Auto Categorization: Currently you have to go through and manually assign every transaction. This would be trivial with an AI API.

-

Multi currency normalization: Bank exports don't always offer a unified currency column, so totals can be massively wrong because they're adding, for example, Yen amounts alongside Euro amounts.

-

Backups & Rollback: The big downside of a g sheet is that it's easy to break. Giving users the ability to rollback in case they break something by accident could be super valuable.

-

-

-

Thinking about Clerk - now that I've used it for a while. Some thoughts

-

The three biggest things that prevent me from using it more:

-

Not having regular reminders - email/home screen widget

-

Sync breaking, and there not being an easy, predictable way to fix it.

-

Not having categorization work on auto pilot.

-

-

Some other observations

-

It's too heavy of a lift to do the monthly reconciliation consistently and move money in/out of vaults etc. But if vaults aren't the right way, then how do I segment out those buckets and have the costs in them not effect my GFS?

-

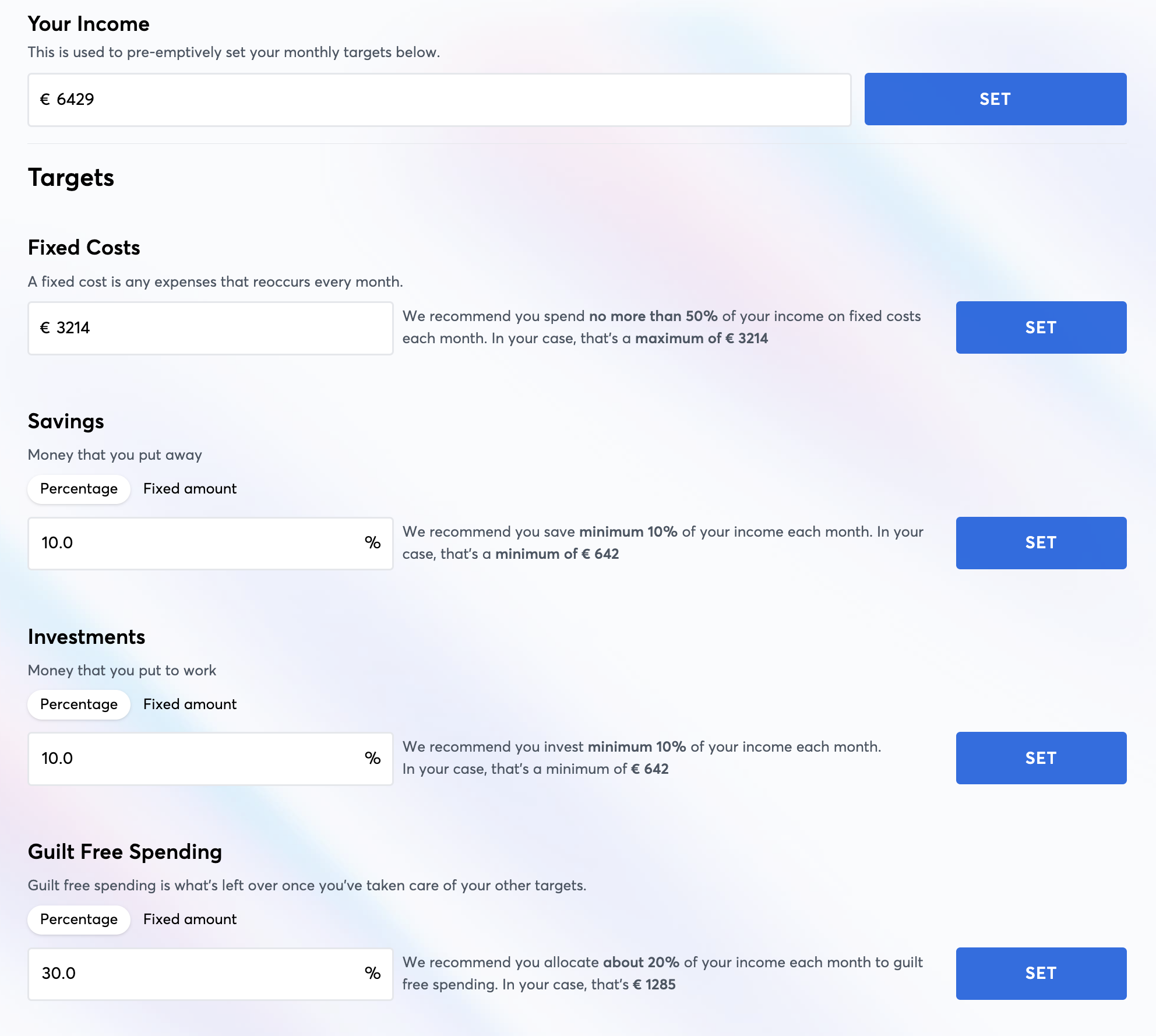

Having an income target is probably unnecessary in most cases, because:

-

Most people have fixed income anyway

-

Missing this target will show up in the other targets

-

-

Having a "Fixed Costs" target also feels kind of silly, given they're meant to be fixed, but it's also not super easy to understand if/how they fluctuate over time - see next point.

-

I keep wanting to see how I've done as a trend over time (e.g last 6 months), but right now I can only track progress on a month to month basis.

-

It's not easy to see and keep track of temporary outgoings (loans/deposits). Likewise temporary incomings

-

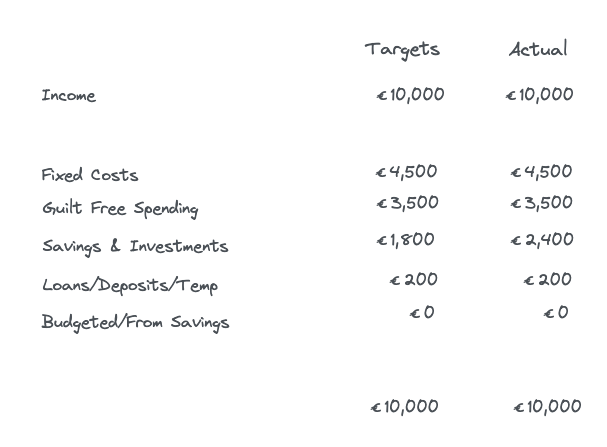

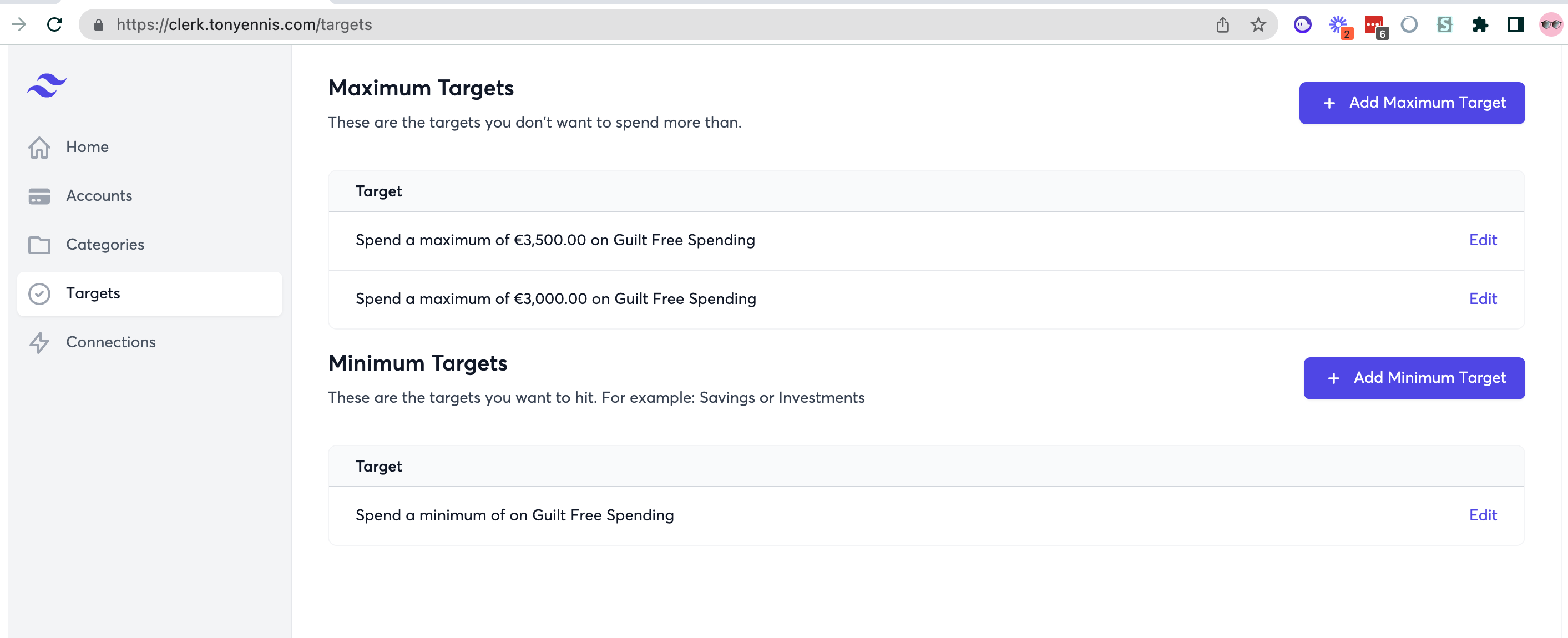

The new table-like target tracker has too much going on to feel useful on an ongoing basis.

-

The two questions I find myself repeatedly wanting to know are:

-

Am I on track to hit my targets with my current spending

-

Am I in danger of hitting zero before my next pay check

-

-

Both of these require some form of forecasting - having some idea when new costs will land.

-

-

Features

-

Add functioning "re-sync" button when a bank account sync is expiring.

-

Remind a user when sync is expiring in a month, have a one click link in the email (which bypasses login) to re-sync. Bump re-sync period up to 6 months.

-

OpenAI powered auto-categorization

-

Daily/weekly email with overview

-

Homescreen widget for iphone

-

Simpler target panels

-

Add ability to tag an incoming outgoing as temporary

-

-

Updates

-

We now have 1. A new targets section on the month view, showing targets and actuals, 2. A new form for inputting targets, and 3. A new left navigation and new icons. I much prefer it this way but we'll see how the beta testers like it.

-

-

-

-

Tasks

-

Fix delayed jobs

-

Scheduled Daily task to refresh master Nordigen token (linking bank accounts breaks without this)

-

Update release note docs and publish

-

-

Tasks

-

Make Loom to ask David for feedback on direction for targets

-

Did a little bit of backlog clean-up earlier - realized there are quite a few open tasks, potential releases and directions to move in. My conclusion is that for now the smartest things to focus on are 1. Retention (ensuring the 3 people currently using it are set up to get the most out of and using it regularly), and 2. Activation (make it easier & smoother to on-board more people)

-

Tasks

-

V1 Metabase user dashboard

-

-

-

Bug: Editing categories & editing targets erroneously triggers a shimmer effect

-

David N onboarding

-

Had a great call with David - overall he gave Clerk a 9/10 despite some pretty gnarly bugs. He turned out to be an ideal person to onboard as he's been following a pretty similar system manually for the last few years.

-

Some takeaways and ideas:

-

Would love to have targets per category and/or for periods longer than a month.

-

Pricing: Would see it as being in the sub $10 range. Would pay for it (and I don't say that a lot)

-

(sometimes Nordigen can have an account classified as current that's actually savings.)

-

Bug: Editing categories & editing targets erroneously triggers a shimmer effect

-

Idea: Let me see a selection of my transactions as I'm creating new categories

-

On transaction edit form - two dropdowns show "Please select" but neither has a label

-

-

Create and implement new animated modals

-

-

Mock up new potential designs for "Target" panel, showing more info per pane

-

-

Implement beginnings of the instant-load effect for the middle scroller, to give the feeling of snappiness when a link is clicked

-

Play with design for new low-fidelity section

-

-

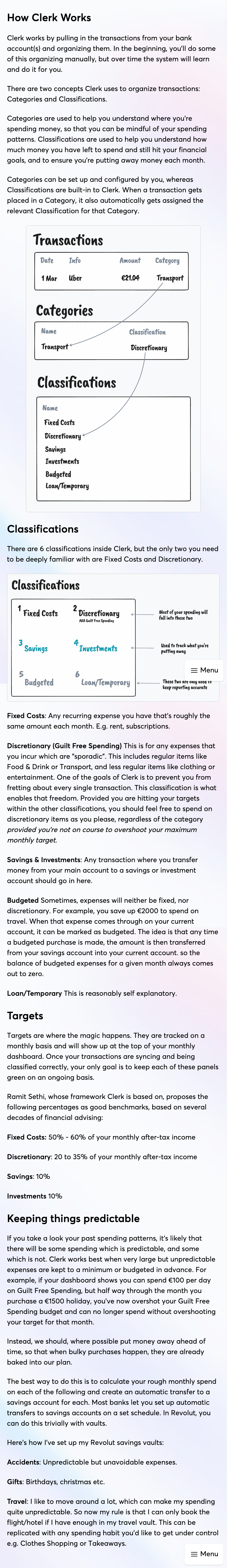

Write up "How Clerk Works"

-

-

Update: Onboarded our first beta user today (Megan). Had several learnings which I'll write up separately.

-

Tasks

-

Save and store additional information about accounts (account type, json_data)

-

Set bank account names based on the names returned by Nordigen (savings accounts now supported)

-

Auto fetch transactions when user first connects new account

-

Remove "Connections" menu item as Accounts does the same thing.

-

Improve display/behaviour of targets

-

-

Remove red/green borders on target panels

-

Remove red border on uncategorised

-

Show remaining per day

-

-

Click target panel to filter transactions, instead of collapsing inside a card

-

Get mobile looking/working reasonably well

-

Borders & padding

-

Add temporary bottom right menu button

-

-

-

Test out new subtle color background

-

Copied from tailwindcss.com. My first impression is that I quite like this. Will let it sit for a while

-

-

-

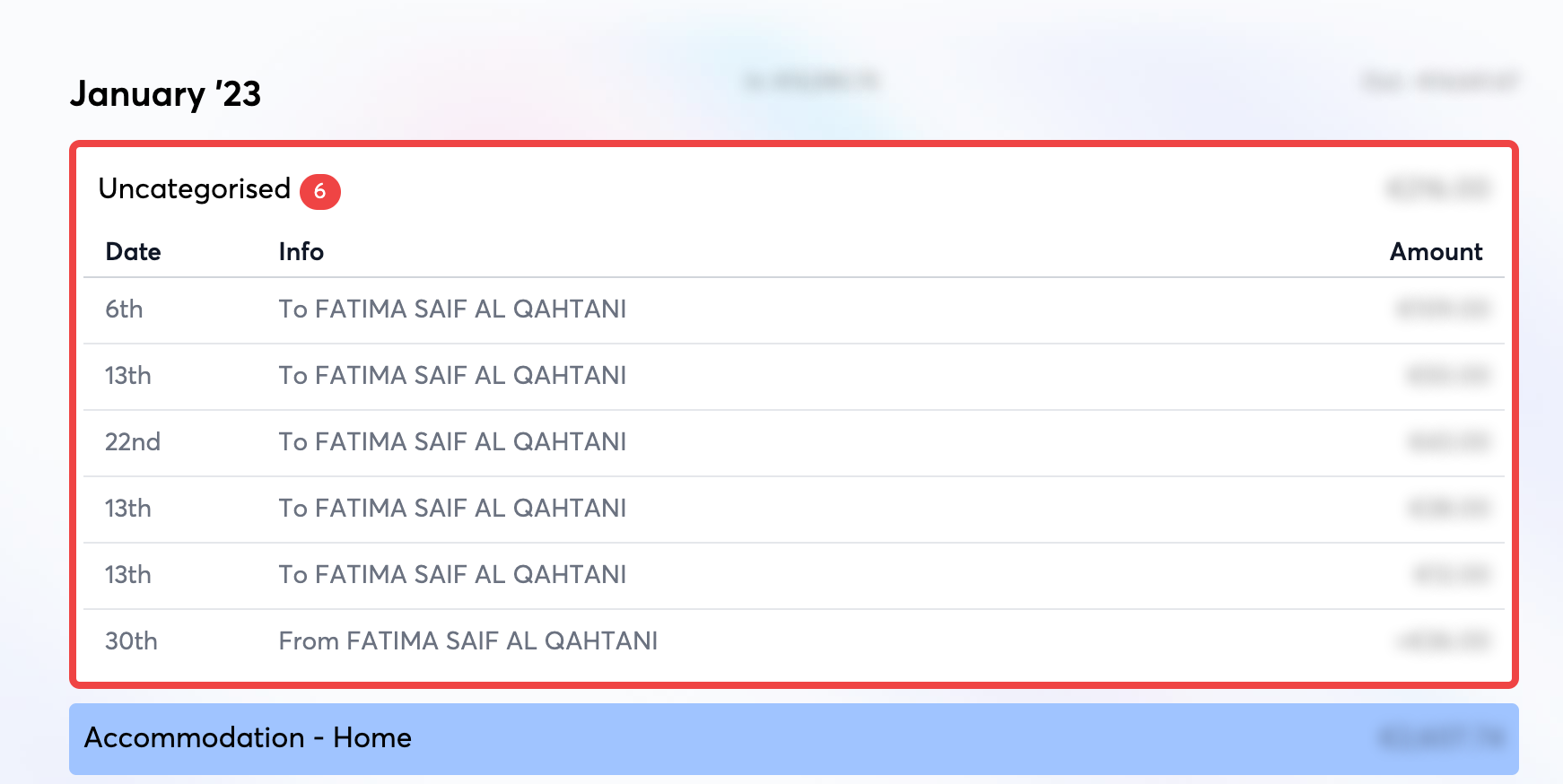

Add red border to uncategorized transactions to incentivise users to categorize

-

-

Add sync button to the transactions home

-

-

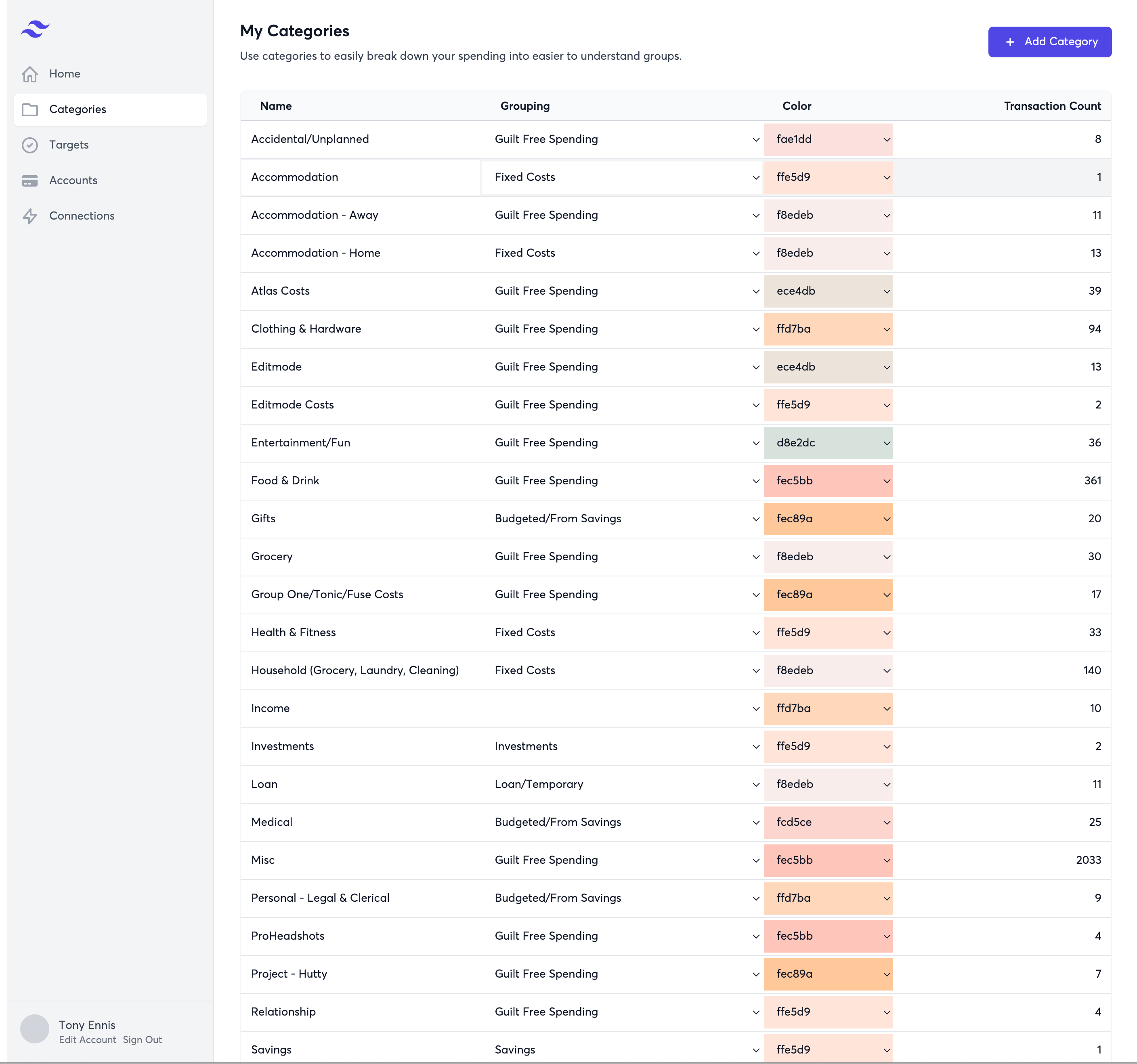

Clean/Organize categories section

-

-

Fix uncategorized reordering

-

Keep active section open after moving a transaction to another category

-

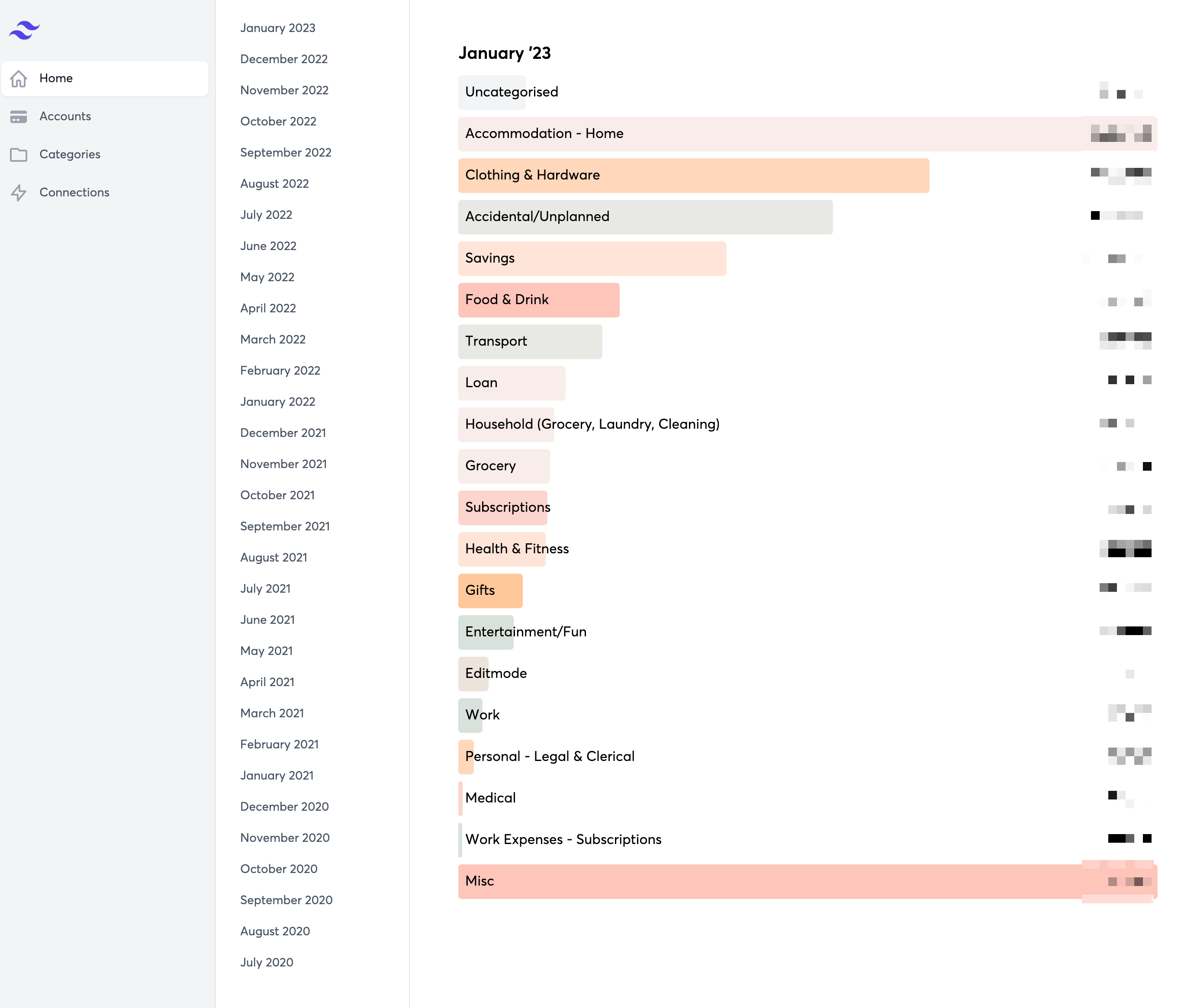

Implement new 2 panel tailwind layout with month grouping 😍

-

-

Add stylus blur styles to make it easier to take vids and screenshots

-

-

Set First month as active by default on home view

-

-

Made really great progress on the main overview screen on the plane home from Geneva.

-

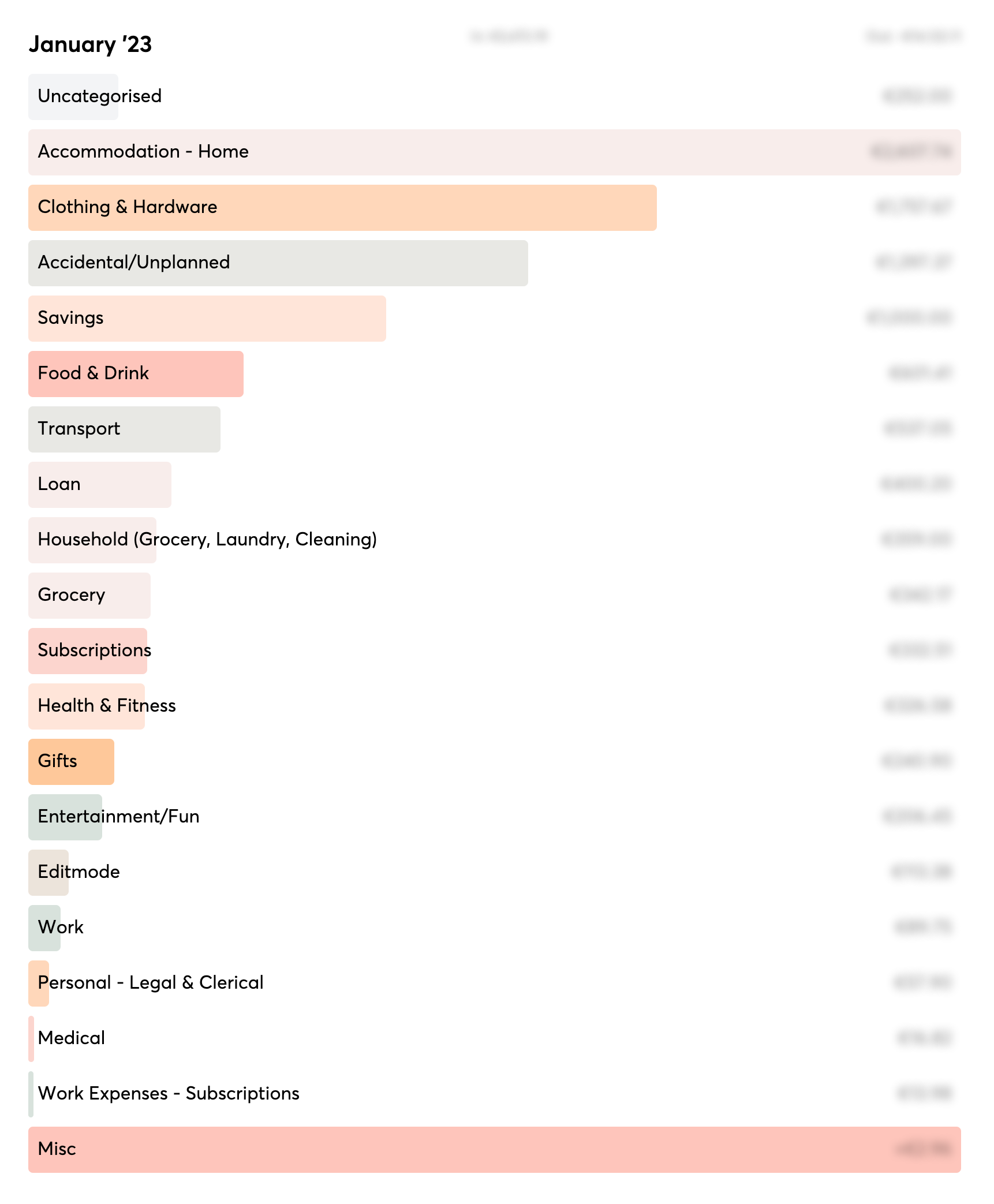

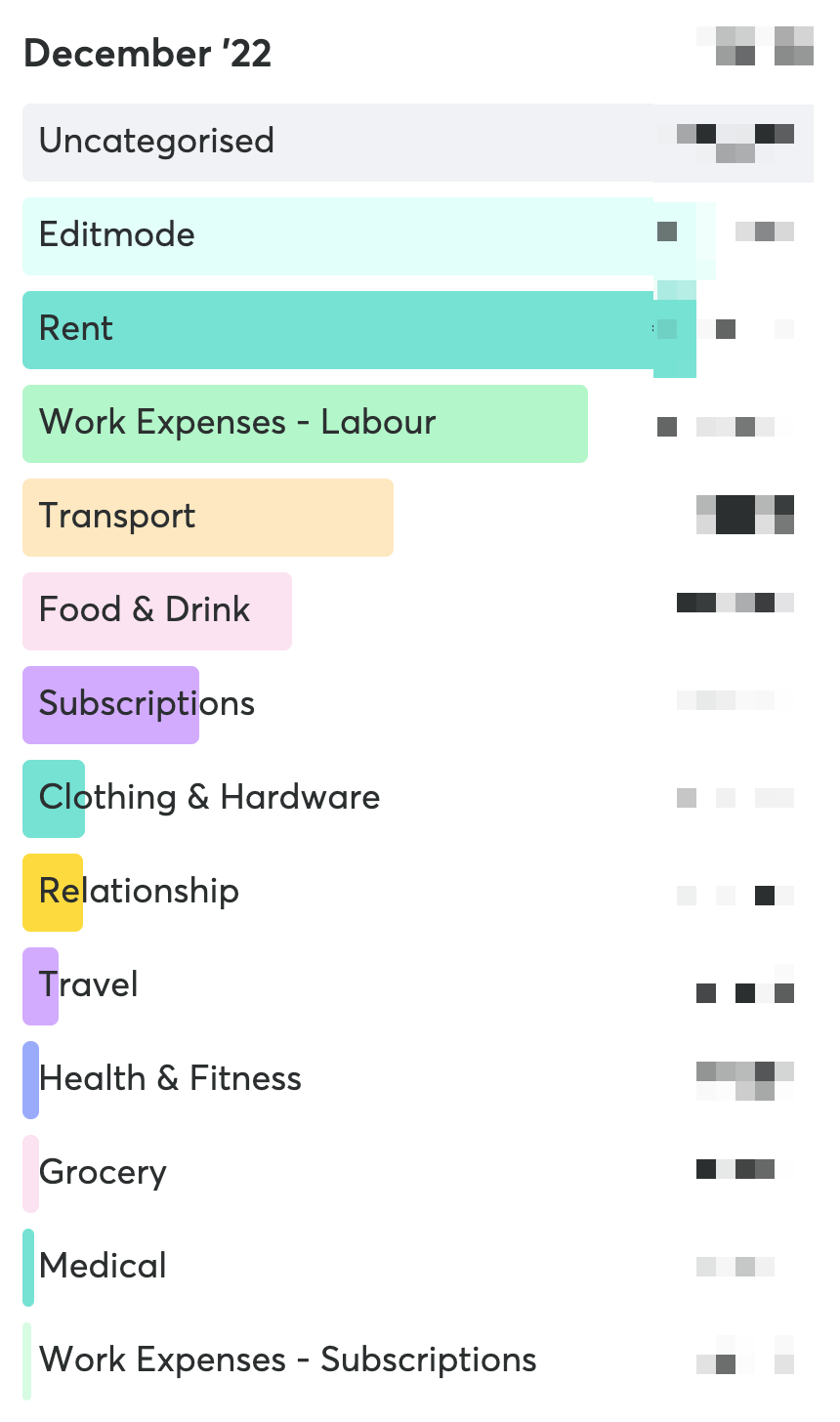

Monthly overview section

-

The monthly overview allows you to get a birds eye view of how you've spent money in the months gone by, and quickly categorize transactions on a per transaction or batch basis.

-

-

By default, your transactions are broken down by category. Transactions with no category will be shown as "Uncategorized".

-

Clicking on any of the bars reveals a list of the transactions for that category

-

-

By default, the "Uncategorized" section is ordered by the transaction name, and the other sections are ordered by the day of the month.

-

Fix Wise transaction enrichment bug

-

Enrich past wise transactions with no data

-

Start thinking about categorization

-

Best way to categorize for a period is likely:

-

Order by transaction name alphabetically (to group similar transactions)

-

Click and Drag to select a group

-

Once mouse is released, trigger input with autocomplete to apply category

-

-

Second option

-

Allow user to define buckets or categories up front.

-

Then use AI to auto categorise transactions, then give a UI to review and correct

-

-

-

Get a url I can go direct to regularly

-

Can now go to clerk.tonyennis.com and see the dashboard page

-

-